13.2k Followers, 37 Following, 265 Posts - See Instagram photos and videos from @pncbank.

- PNC has the right banking products and financial expertise for individuals, small businesses, and large institutions. Choose PNC for checking accounts, credit cards, mortgages, investing, borrowing, asset management and more — all for the achiever in you.

- Customers can access and apply for PNC Remote Deposit directly through PNC Online Banking. Once approved, businesses will be sent their scanner hardware. Instructions for installing your scanner and getting started are included in the Users' Guide. Sign in to PNC Online Banking. Click the Business Tools tab. The Business Tools Summary will appear. Click Enroll Now on the PNC Remote Deposit tile. This opens the How it Works page. The PNC Remote Deposit.

- Direct Deposit Set up direct deposit for your paycheck or government benefit payments and get access to your money right away. It's easy to complete PNC's Direct Deposit Form (or.

- The PNC safe deposit box cost can vary depending on the bank and the size, but they range from $42 for a 3×5 box to $75 for a 10×10 box. Early Account Closure Fee PNC Bank charges a $25 fee to close an account that has been open for less than 180 days.

Pnc Direct Deposit Checks

The PNC Bank direct deposit authorization form is a standard method for authorizing an entity, such as an employer, to deposit payments directly to a PNC Bank Account of your choosing. Some employers may have their own forms or procedures, so it is generally recommended to check with this entity before submitting this form. The Direct Deposit Payments will occur at the pace set by the Paying Entity, thus you should make sure you are abreast of this entity’s pay schedule.

Step 1 – Use the “PDF” button on the right hand side of this page to download a blank copy of the PNC Bank Direct Deposit Authorization Form. If you do not have a PDF program or a form friendly browser, you will need to print this form out then fill it out manually. Two copies are provided in this PDF. This may be handy should an Employer require such forms in duplicate or you wish to keep one for your records (recommended).

Step 2 – Under the Title locate the two check boxes, labeled “New Request” and “Change Request.” Here, you must define the reason for submitting this form. If this is a New Request and you do not have a Direct Deposit Account set up then you may choose the first box. If you do have a Direct Deposit transfer set up and wish to change your account, then select the “Change Request.”

Step 3 – Next you will need to enter your full Name in the box labeled “Name.”

Step 4 – Report your Social Security Number

Step 5 – In the Boxes labeled “Address” and “City, State, Zip Code,” enter your Full Address as it is reported with PNC Bank.

Step 6 – The next paragraph will verify your consent to allow a specific organization or company to report deposit payments directly into your account. You must report the Full Name of this Company or Organization on the blank line provided preceding the words “hereinafter called “Originator.””

Pnc Direct Deposit Form

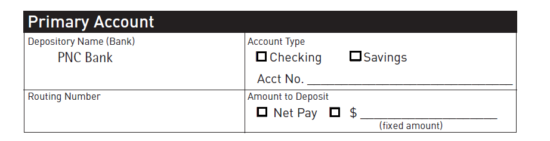

Step 7 – Locate the words “Account Type” in the first row of the table titled “Primary Account.” If you prefer to use your Checking Account to receive the deposit then select the first check box. If not, then you may select the second check box to use your Savings Account to receive the Deposit. Below this, you must enter the full Account Number where the deposit should be made.

Pnc Direct Deposit Holiday

Step 8 – In the box labeled “Routing Number,” you will need to enter the Routing Number for the PNC branch where you keep your account.

Step 9 – In the box labeled “Amount to Deposit,” you may decide precisely how much of your payments will be directly deposited. If you would like the entirety of the payment to be deposited then select the check box labeled “Net Pay.” If you would like a specific amount (to be deposited) then select the second check box and enter this amount on the blank line following the dollar sign. If you wish to deposit the Full Amount into one account proceed to Step 11. If you would like to deposit funds to two Accounts whenever you are paid, then proceed to Step 10.

Step 10 – In some cases, it may be better to split the amount being paid to be deposited across two destinations. If so, you will need to report where the balance of the payment from Step 9 must be deposited. In the table labeled “Optional Secondary Account,” report the Account Type of the second Account by selecting either the check box labeled “Checking” or the check box labeled “Savings” and enter the Account Number below this. You will also need to enter the correct Routing Number for the PNC branch, where you bank, in the box labeled “Routing Number.” Finally, under the words “Amount to Deposit,” check the second box then enter the Amount to be deposited.

Step 11 – Below the Verification Paragraph, report the Date this form is being Signed in the box labeled “Date” then Sign your Name in the “Signature” box.

Step 12 – Next, you will need to submit this form to the proper Department of your place of employment. In many cases, this will be the Payroll Department however smaller companies may have unique structures. Make sure you submit this to the proper office. It is highly recommended to keep a copy for yourself.

Save