| You are here : | Products Personal Interest Rates |

Interest Rates - Deposit

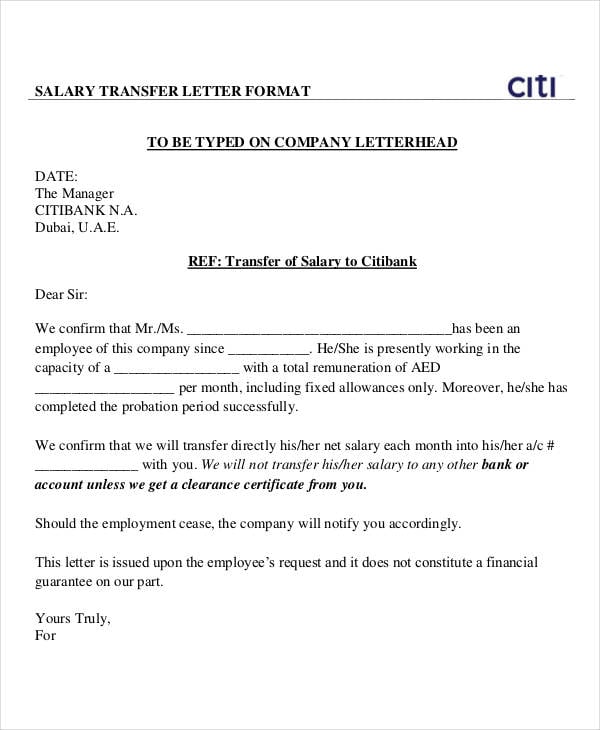

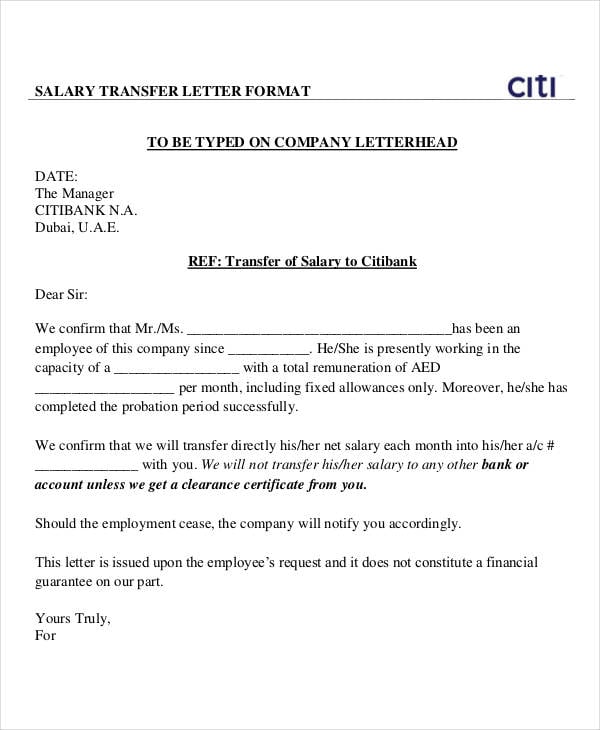

| Interest rates effective from 15/12/2020 (Percentage per Annum) |

| Period | < Rs. 2 Cr | | 7 – 14 Days | 3.00 | | 15 – 30 Days | 3.00 | | 31 – 45 Days | 3.00 | | 46 – 90 Days | 3.75 | | 91 - 120 Days | 4.25 | | 121 to 180 Days | 4.30 | | 181 Days to <1 Year | 4.50 | | 1 Year | 5.25 | | >1 Year to 2 Years | 5.30 | | >2 Year to 3 Years | 5.50 | | >1 Year to 3 Years | - | | >3 Years to 5 Years | 5.55 | | >5 Years to 10 Years | 5.60 |

|

- Interest rates are subject to change. Hence depositor will ascertain the rates as on the date of placement from the website.

- Aggregate value of deposits placed by a depositor on the day for an identical tenor will be taken for deciding applicable interest rate.

- For interest rates for deposits of Rs. 2 Crores and above, Please contact our nearest branch.

|

| Interest is calculated on daily product basis and is credited on quarterly basis in the months of April, July, October and January every year. |

| Saving Bank deposits rates w.e.f. 31.03.2020 |

Bank Of Ireland Discussion Activity. Bank Of Ireland 365 Regular Savings Account - Savings Q: If I have 50K on deposit with BOI, what is the best account to have it in, in order to get the best interest rate, without any term deposit restrictions. I wish to have fulltime access to funds.

- Savings Bank deposit slabs Existing Rate of Interest Revised Rate of Interest w.e.f.; SB Deposit accounts with balances upto Rs.

- CIBIL Based Rate of Interest and REPO Based Rate of Interest C & IC Advances- MCLR- Revision in Spread from The Bank’s Base Rate has been revised from 9.00% pa.

- Quarterly interest payment is effective from May 2016 and is invariably credited on regular basis in SB account irrespective of the operational status of the account. Any change/ revision in interest rate on Savings Bank Deposits shall be notified to the customers through Bank's website i.e. Saving Bank Deposit Rate of.

- Here are the best online savings account interest rates. If you are looking for a low-risk way to save money over a long period of time, high yield savings accounts may be a good option for you.

| On balance upto & including Rs. 25.00 lakhs | 3.00% p.a. |

| On balance above Rs. 25.00 lakhs |

Saving Account Interest Rate

- Apply Online

- Interest Rates

Boi Saving Account Interest Rate 2019